Ascend Credit is great for people who….

1. Haven’t had much credit

And want to build their score

4. Are new to South Africa

And are looking to build a credit profile

2. Have been turned down for credit

By credit card, loan and mortgage providers

5. Have a poor credit score

And want to improve their score

3. Are looking to get a car or home

And struggling to get a good deal

6. Want to fix issues on their credit report

And need help fixing them

Does this sound like you?

Then Ascend can help

Unlock financial freedom

A better credit score opens up a world of possibilities

Improved credit eligibility

Wave goodbye to credit application rejections

Access a range of deals

Start choosing the loans and credit cards you actually want

Save money on interest

Put money back into your pocket & live a better life

What others have to say

“Ascend Credit has been instrumental in helping me take charge of my credit and achieve my financial goals.”

Kgomotso Mngudlwa

“I am truly grateful for the positive impact Ascend Credit has had on my financial journey.”

Raymond Adams

“Thanks to Ascend Credit, I have been able to build a solid credit foundation and work towards a brighter financial future.”

Veronica Nkosi

Savings from credit score improvement

Better credit score = lower interest rates → Saving thousands over time.

*A R240 000 personal loan with an APR of 27.5%

*The loan term is 60 months

**A R120 000 credit card balance with an APR of 20.5%

**Monthly repayment on the credit card is R2398

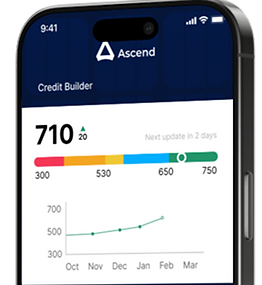

Every point matters

Lenders profit by charging interest on borrowed money, and a lower credit score means higher interest rates, potentially resulting in you repaying significantly more than the original loan amount. By improving your credit score with Ascend Credit, you can lower your interest rates and save money on borrowing costs overall.

Ascend plans

Choose one our plans to start building your credit

Ascend Save

Free

Included in your plan

-

A savings product that turns your monthly contributions into a tool to build your credit history

-

Affordability insights to help you qualify for more credit

-

Personalised tips to develop healthy credit habits

The Details

At the start of the period, Ascend loans you an amount. But, the money stays in an account that cannot be touched for 12 months. Every month you pay back a set amount and these payments are reported back to credit bureaus, helping build a positive credit history. At the end of the 12 month period you receive the total amount saved.

Ascend Data

Data Plan Dependant

Included in your plan

-

A choice of data plans that allows you to connect and build your credit score

-

Affordability insights to help you qualify for more credit

-

Personalised tips to develop healthy credit habits

-

Report to all major credit bureaus

The Details

You will sign up for one of our month to month data plans, which can either be with Vodacom or MTN, and pay a fixed amount each month for your plan. These payments are reported to credit bureaus, helping you build a positive credit history. Plans can be cancelled anytime.

Ascend Device

Device Dependant

Included in your plan

-

Access to a wide variety of cellphones that you can purchase, while building your credit score

-

Affordability insights to help you qualify for more credit

-

Personalised tips to develop healthy credit habits

-

Report to all major credit bureaus

The Details

Ascend helps you access the device you need through a simple 12-month rent-to-own plan. You make affordable monthly payments—starting with a 25% upfront fee—and at the end of your term, the device is yours. Each on-time payment is reported to credit bureaus, helping you build a stronger credit profile and move closer to your financial goals—whether that’s owning a car, qualifying for a home loan, or gaining more financial freedom.